The smart Trick of Estate Planning Attorney That Nobody is Talking About

The smart Trick of Estate Planning Attorney That Nobody is Talking About

Blog Article

Estate Planning Attorney Can Be Fun For Everyone

Table of ContentsHow Estate Planning Attorney can Save You Time, Stress, and Money.5 Easy Facts About Estate Planning Attorney DescribedWhat Does Estate Planning Attorney Do?The Only Guide for Estate Planning Attorney

Your attorney will also help you make your records authorities, setting up for witnesses and notary public trademarks as needed, so you do not need to fret about trying to do that last action on your very own - Estate Planning Attorney. Last, however not least, there is beneficial assurance in developing a relationship with an estate planning lawyer who can be there for you down the roadwayPut simply, estate planning lawyers offer worth in lots of ways, far beyond merely offering you with printed wills, trust funds, or various other estate intending documents. If you have questions concerning the procedure and wish to find out more, call our workplace today.

An estate preparation lawyer helps you formalize end-of-life decisions and legal files. They can set up wills, develop trust funds, create health and wellness care instructions, develop power of lawyer, produce succession strategies, and much more, according to your desires. Collaborating with an estate planning attorney to finish and oversee this lawful documentation can help you in the complying with eight locations: Estate planning attorneys are experts in your state's trust, probate, and tax obligation legislations.

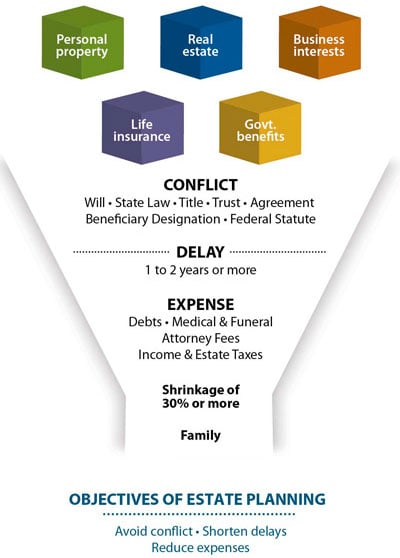

If you don't have a will, the state can make a decision exactly how to divide your assets amongst your heirs, which may not be according to your dreams. An estate preparation lawyer can aid arrange all your lawful papers and distribute your assets as you want, potentially avoiding probate.

The Only Guide for Estate Planning Attorney

As soon as a client dies, an estate plan would certainly dictate the dispersal of assets per the deceased's instructions. Estate Planning Attorney. Without an estate plan, these choices might be delegated the next of kin or the state. Duties of estate organizers include: Producing a last will and testament Establishing trust accounts Naming an executor and power of attorneys Identifying all recipients Naming a guardian for small children Paying all financial debts and reducing all taxes and lawful charges Crafting directions for passing your values Developing preferences for funeral plans Completing directions for treatment if you come to be sick and are not able to make choices Obtaining life insurance coverage, disability revenue insurance policy, and long-lasting care insurance coverage An excellent estate plan should be upgraded regularly as customers' financial scenarios, individual inspirations, and government and state laws all evolve

Just like any profession, there are qualities and abilities that can aid you achieve these goals as you work check my source with your customers in an estate planner duty. An estate preparation career can be right for you if you possess the following traits: Being an estate organizer means assuming in the long-term.

All About Estate Planning Attorney

You must help your client anticipate his/her end of life and what will certainly occur postmortem, while at the exact same time not home on dark thoughts or feelings. Some customers might come to be bitter or troubled when contemplating death and it could drop to you to assist them this website with it.

In case of death, you may be anticipated to have many discussions and negotiations with surviving household members regarding the estate strategy. In order to stand out as an estate organizer, you might need to walk a great line of being a shoulder to lean on and the specific relied on to interact estate preparation issues in a prompt and specialist way.

tax obligation code altered hundreds of times in the 10 years between 2001 and 2012. Expect that it has been altered additionally considering that after that. Relying on your customer's financial earnings brace, which might advance toward end-of-life, you as an estate organizer will certainly need to keep your client's assets in full legal compliance with any local, government, or worldwide tax laws.

What Does Estate Planning Attorney Do?

Gaining this certification from organizations like the National Institute of Qualified Estate Planners, Inc. can be a solid differentiator. Belonging to these professional teams can confirm your abilities, making you extra attractive in the eyes of a prospective customer. Along with the emotional incentive helpful clients with end-of-life planning, estate coordinators take pleasure in the advantages of a stable income.

Estate planning is an intelligent point to do no matter your present health and monetary status. Nonetheless, not so numerous people know where to start the process. The initial crucial thing is to work with an estate preparation attorney to aid you with it. The adhering to are five advantages of dealing with an estate preparation attorney.

A skilled lawyer understands what information to consist of in the will, including your recipients and special factors to consider. It additionally offers the swiftest and most efficient technique to transfer your assets to your beneficiaries.

Report this page